Elimination of 2 floor itemized deductions news family wealth and estate planning tax tax planning and compliance manufacturing and distribution real estate and construction historically taxpayers have been afforded the opportunity to include various expenses in excess of 2 percent of their adjusted gross income agi in the.

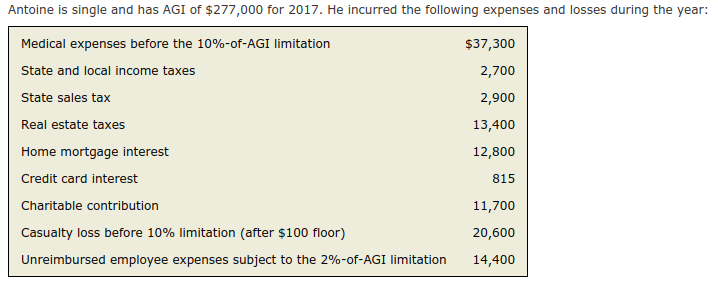

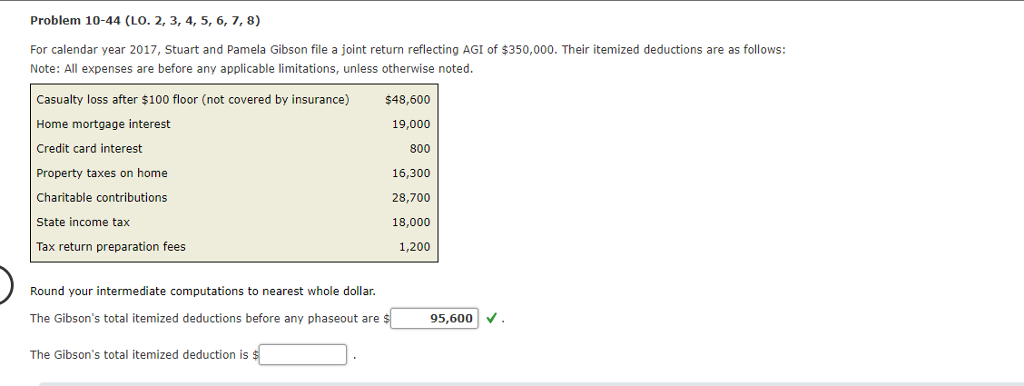

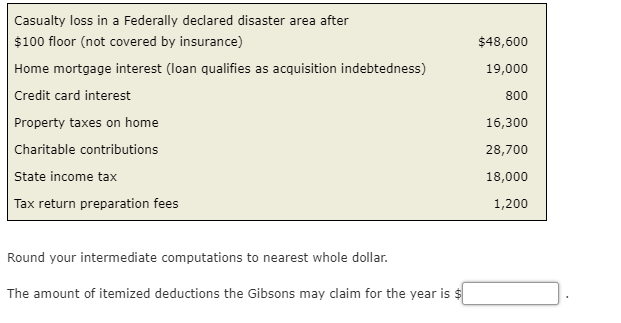

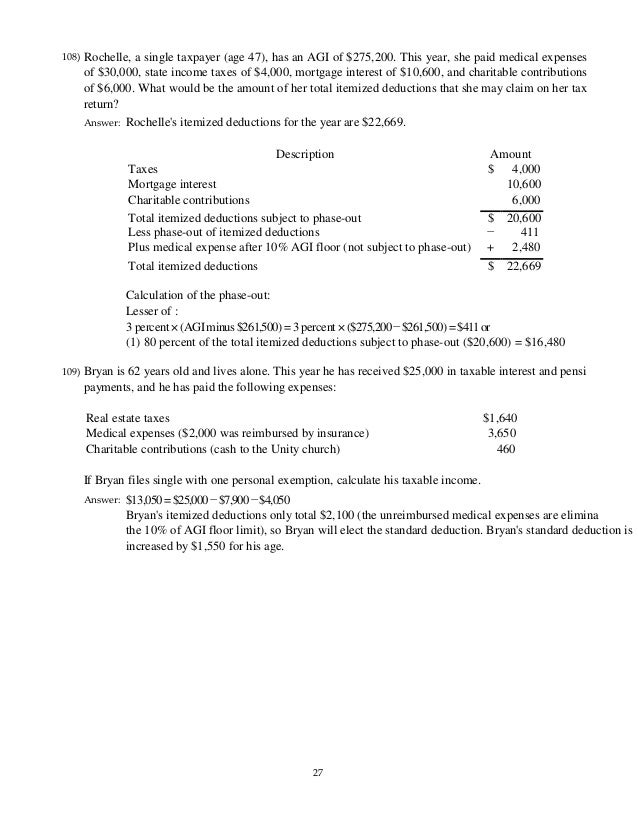

Itemized deduction agi floors.

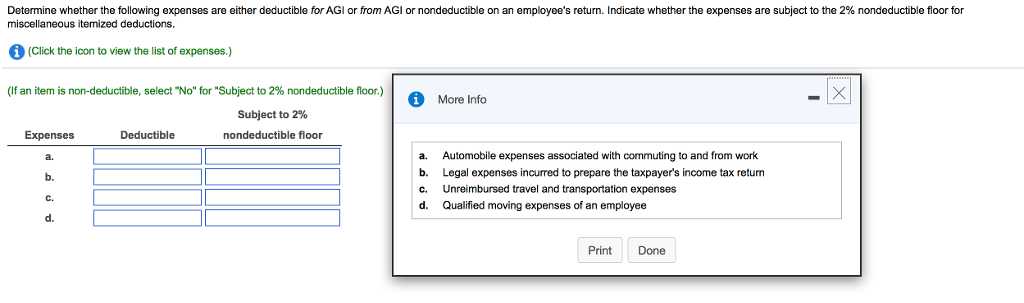

As of the 2018 tax year itemized deductions for job related expenses or other miscellaneous expenses outlined below that exceeded 2 of your income have been suspended.

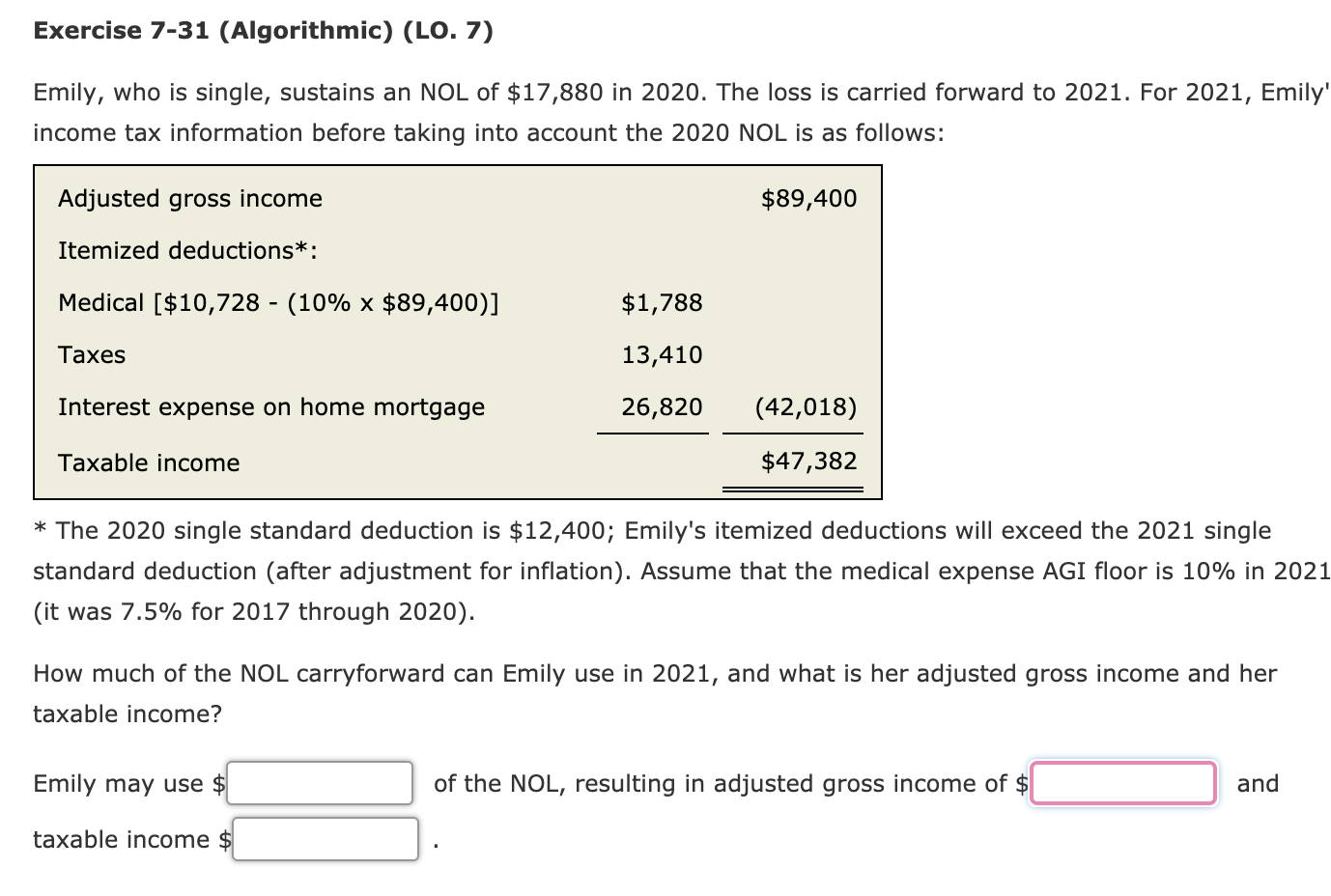

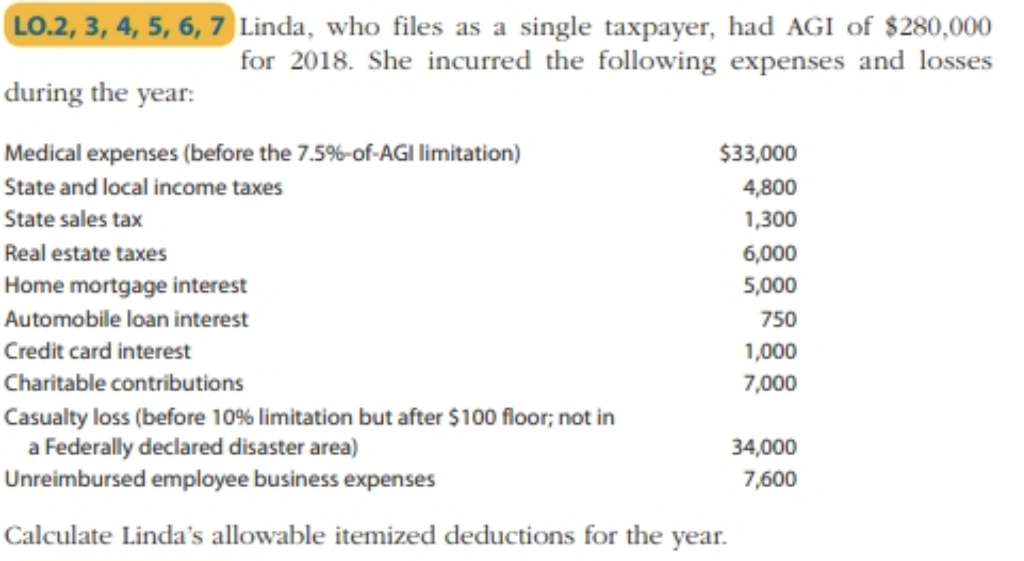

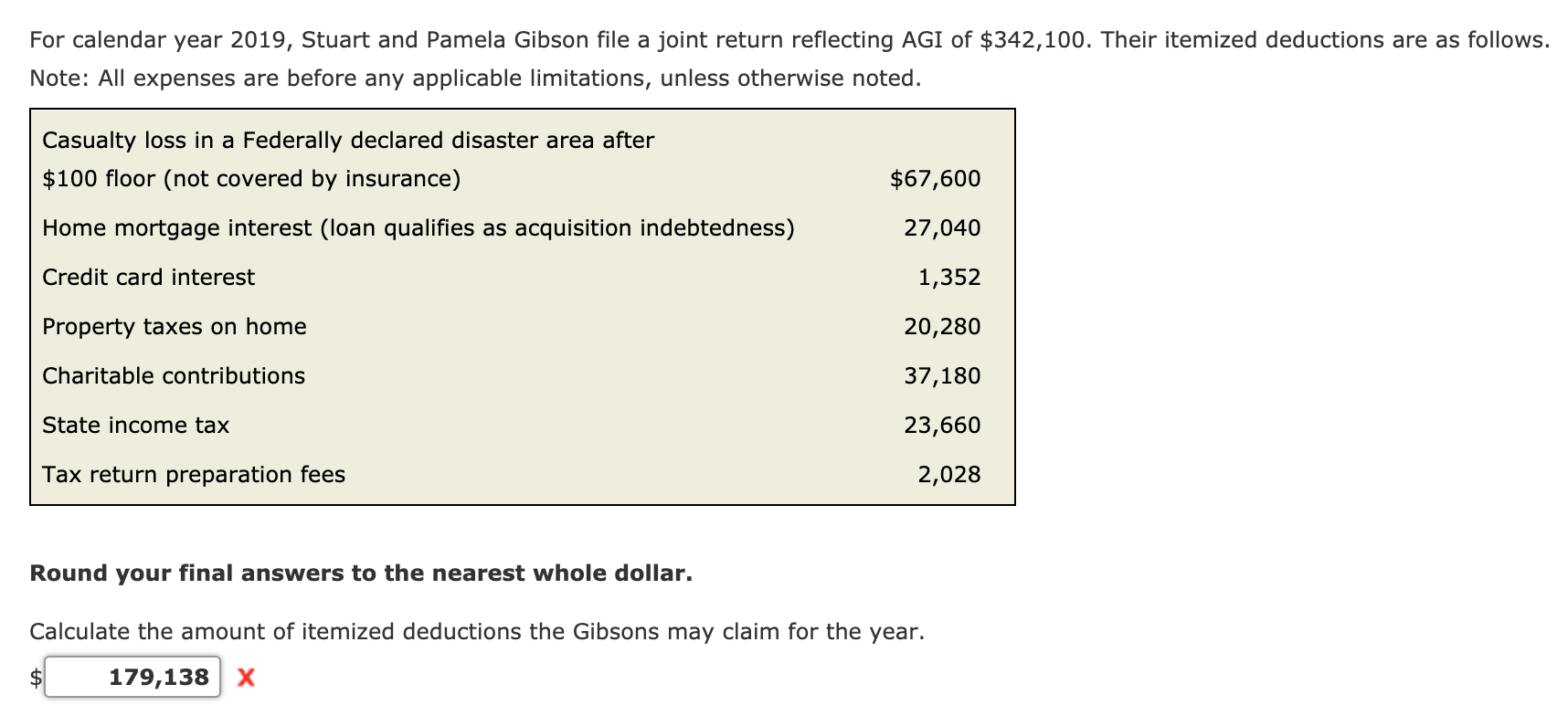

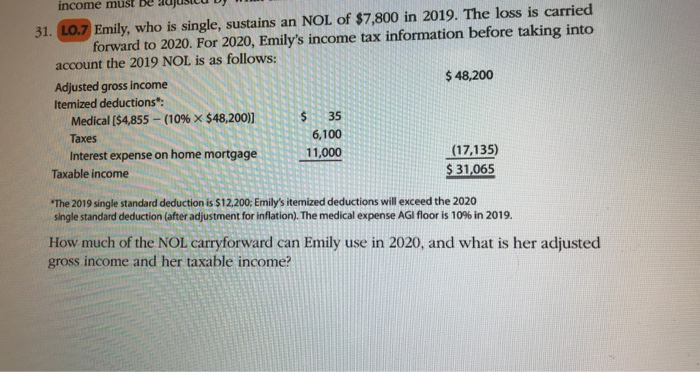

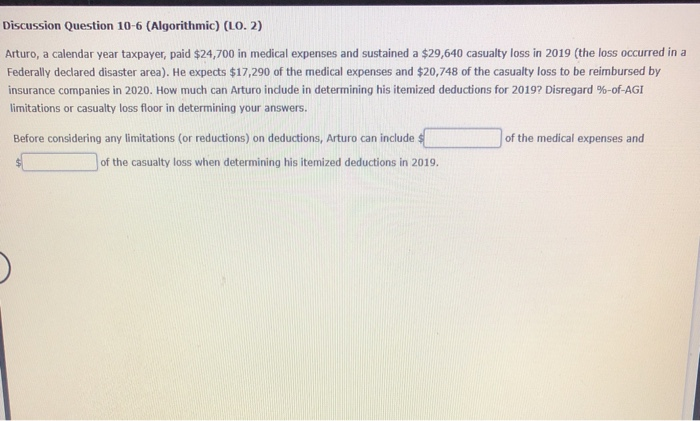

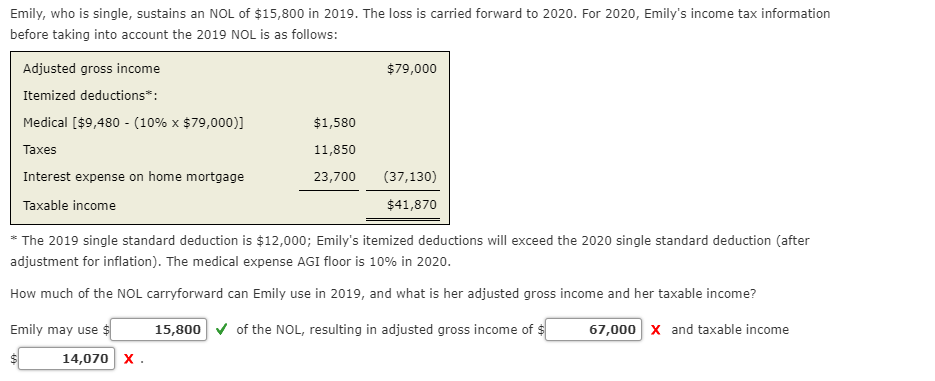

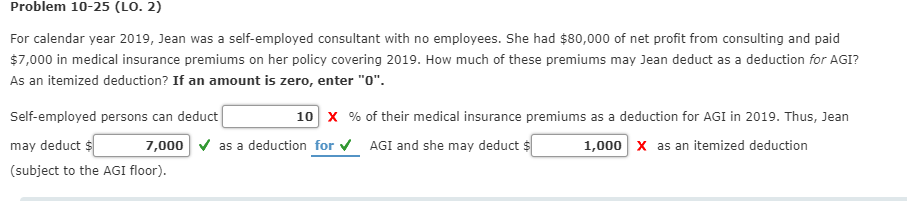

This means that if your agi is 55 000 and you had 7 500 in qualifying medical expenses your deduction would be limited to 3 375 the amount that exceeds 4 125 or 7 5 of your agi.

If your adjusted gross income for 2019 was 50 000 only medical expenses that exceed 3 750 would qualify for the deduction.

So if john doe has an agi of 100 000 and a 10 agi floor then the first 10 000 of his medical.

This publication covers the following topics.

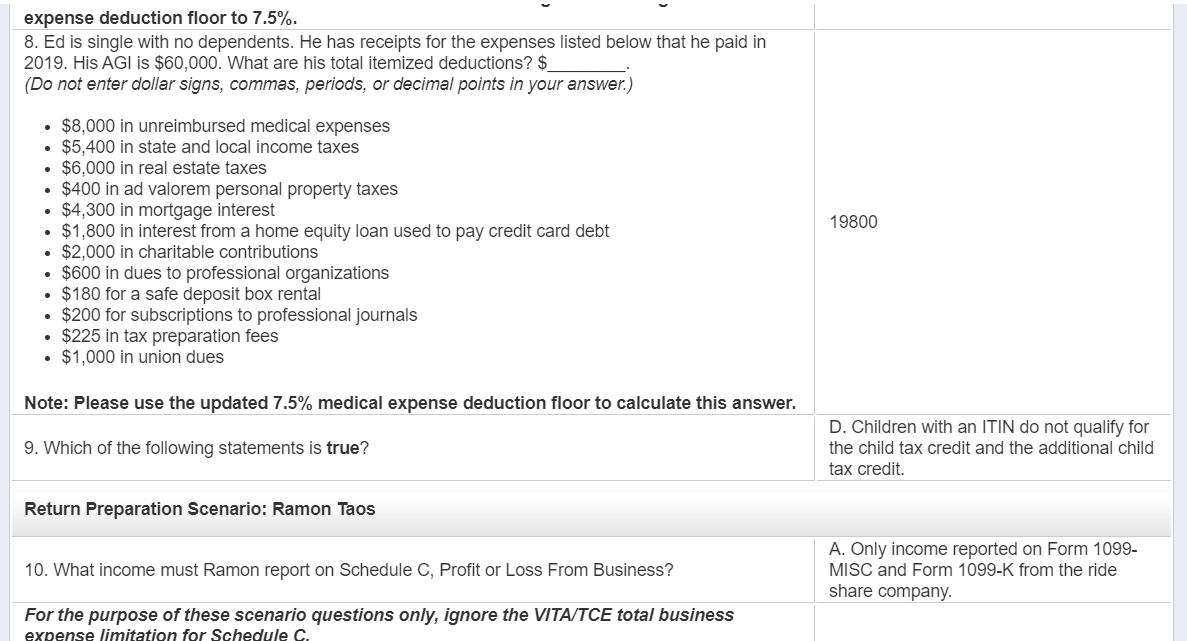

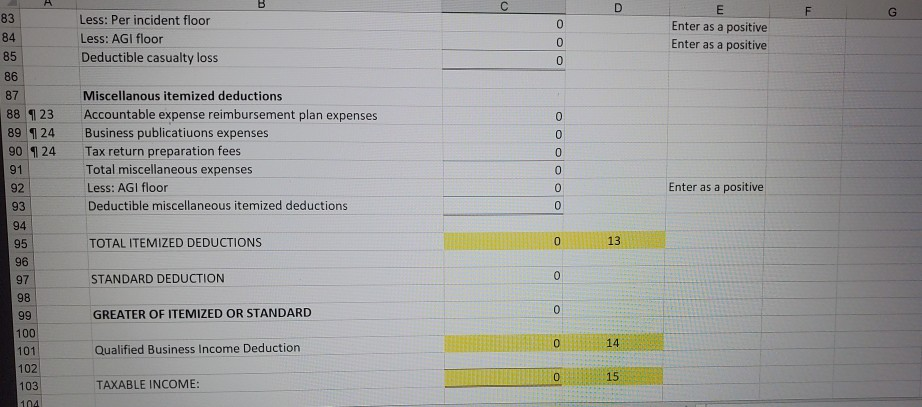

In the case of an individual the miscellaneous itemized deductions for any taxable year shall be allowed only to the extent that the aggregate of such deductions exceeds 2 percent of adjusted gross income.

Miscellaneous itemized deductions are those deductions that would have been subject to the 2 of adjusted gross income limitation.

Before the tcja final year estate and trust excess deductions were passed through to beneficiaries who in turn claimed them as miscellaneous itemized deductions subject to the 2 of agi floor.

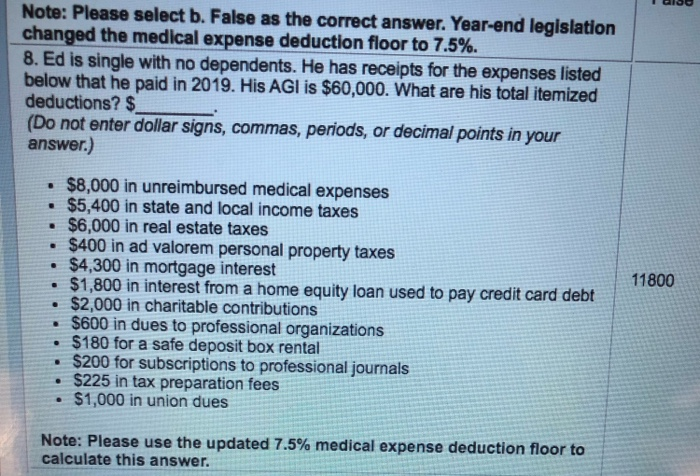

Also included is tax preparation fees and safety deposit box fees.

You can deduct the portion that exceeds 7 5 of your adjusted gross income agi in 2019.

Miscellaneous itemized deductions subject to 2 floor deductions for certain professional fees licenses union etc investment expenses and unreimbursed employee expenses have been suspended.

Since 2 deductions are not available for tax years 2018 2025 proposed regulations clarify that some passthrough items are potentially deductible.

This includes mileage and the home office deduction for w 2 employees.

To illustrate how the 7 5 threshold works.